VIS (5347-TW), a leading specialty IC foundry service provider, held an investor conference today on January 31st. Its 4Q18 revenue was NTD7.7bn (-0.6% QoQ, +20.9% YoY). Its 3Q14 GM rose by 2 ppts QoQ and 4.1 ppts YoY to 38%. Its operating margin increased by 1.3 ppts QoQ and 2.5 ppts YoY to 26.9%. Its net profit was NTD1.928bn (+15.5% QoQ, +58.4% YoY) with EPS of NTD1.16, setting a new record high.

VIS’ FY18 revenue was NTD28.928bn (+16.1% YoY) with GM of 35.2% (+3.2% YoY). Its FY18 operating margin was 24.7% (+3.7% YoY). And, its net profit was NTD6.166bn (+36.9% YoY) with EPS of NTD3.72, setting another new high.

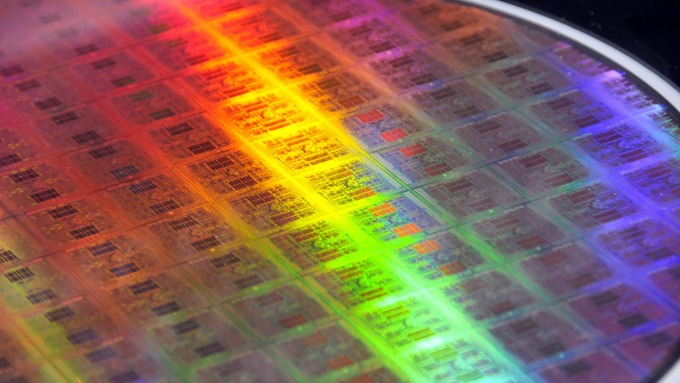

VIS also announced the purchase of GlobalFoundries’ Fab 3E in Singapore, including the plant, facilities, equipment, and MEMS intellectual property rights. For now, monthly capacity of the plant is approximately 35k 8” wafers, and the transaction amount to NTD236mn. The settlement date is expected to be on December 31st this year. VIS told that after capacity expansion, the capacity will be increased 400k wafers per year.

Leuh Fang, VIS’ president, said that VIS gained the opportunities of capacity expansion through the purchase, and ensured company's growth momentum in the future. The company has rich experiences in capacity expansion, transforming DRAM plants to wafer foundries. This is expected to be a win-win decision. VIS will meet the customer's demand for capacity and technology, continue to profit and grow, and to accomplish the stakeholder benefit.

更多精彩內容請至 《鉅亨網》 連結>>

我是廣告 請繼續往下閱讀

VIS also announced the purchase of GlobalFoundries’ Fab 3E in Singapore, including the plant, facilities, equipment, and MEMS intellectual property rights. For now, monthly capacity of the plant is approximately 35k 8” wafers, and the transaction amount to NTD236mn. The settlement date is expected to be on December 31st this year. VIS told that after capacity expansion, the capacity will be increased 400k wafers per year.

Leuh Fang, VIS’ president, said that VIS gained the opportunities of capacity expansion through the purchase, and ensured company's growth momentum in the future. The company has rich experiences in capacity expansion, transforming DRAM plants to wafer foundries. This is expected to be a win-win decision. VIS will meet the customer's demand for capacity and technology, continue to profit and grow, and to accomplish the stakeholder benefit.

更多精彩內容請至 《鉅亨網》 連結>>